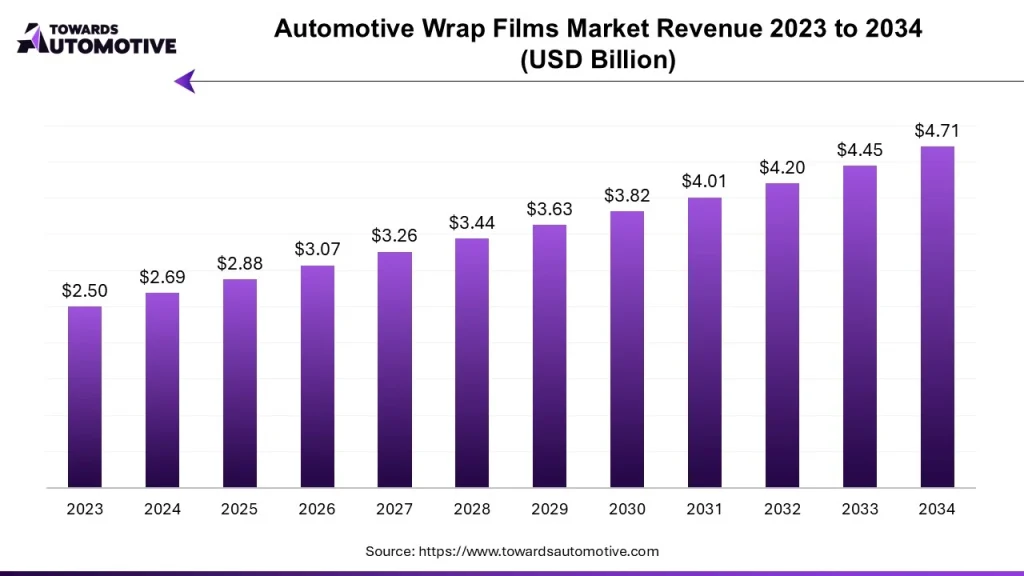

The global automotive wrap films market is projected to grow from USD 2.88 billion in 2025 to USD 4.71 billion by 2034, showcasing a compound annual growth rate (CAGR) of 5.93%. This growth is underpinned by the rising demand for vehicle customization, particularly among the younger demographic, as well as advancements in vinyl wrapping technologies.

Automotive wrap films, a key segment of the advanced materials industry, are primarily used to enhance aesthetics and protect vehicle surfaces. These films are available in two major types: cast films and calendered films. They are applied to a variety of vehicles including passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs), distributed through both online and offline sales channels.

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/download-databook/1147

Key Market Highlights

-

North America emerged as the revenue leader in the automotive wrap films market in 2025.

-

Asia Pacific is expected to register the fastest CAGR during the forecast period.

-

Cast films dominated the market by type, while calendered films are gaining traction due to cost-effectiveness.

-

Offline channels currently lead in sales, but online platforms are anticipated to experience significant growth.

Emerging Trends Shaping the Market in 2025

Strategic Partnerships

Automotive wrap manufacturers are increasingly forming partnerships to produce high-quality, innovative wraps. For example, in February 2025, Avery Dennison collaborated with Yiannimize to develop new wrap films tailored for the U.S. market.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-sample/1147

Business Expansions

Companies are investing heavily in expanding their production facilities globally to meet increasing demand. This includes new centers for wrap manufacturing and detailing services.

Vehicle Branding and Advertising

Car manufacturers and dealerships are turning to vehicle wraps for promotional purposes. Wrapped demo vehicles are being used as mobile advertisements to attract consumer attention in competitive markets.

Product Insights

Cast Films Lead the Market

Cast films held the largest market share in 2025, driven by demand for premium-quality self-adhesive vinyl wraps. Their benefits—including superior clarity, quiet unwinding, and consistent thickness—make them a preferred choice for high-end automotive applications.

Calendered Films Show Strong Growth Potential

Although less expensive, calendered films are becoming increasingly popular for customizing vehicle appearances. Their affordability, durability, and ease of application are contributing factors to their growing market share.

If you have any questions, please feel free to contact us at sales@towardsautomotive.com

Distribution Channel Analysis

Offline Segment Dominates Sales

Offline channels, such as car accessory shops and detailing centers, accounted for the majority of sales in 2025. Consumer preference for hands-on selection and physical inspection continues to drive footfall to brick-and-mortar stores. Many manufacturers also offer dealership opportunities to increase local brand presence.

Online Segment Rising Rapidly

Online platforms are gaining momentum as a preferred distribution channel. The proliferation of smartphones and growing e-commerce ecosystems are enabling consumers to purchase automotive wraps conveniently. Discounts, EMI options, and dedicated apps available on platforms like Amazon, Flipkart, and Alibaba are accelerating online sales.

Regional Insights

North America Leads, Asia Pacific Grows Fastest

North America captured the highest revenue share, while Asia Pacific is expected to grow at the fastest rate. The growth in Asia Pacific is fueled by the rising number of car detailing centers and increasing online availability of wrap films in countries like India, China, Japan, and South Korea.

Significant regional activity includes the March 2025 partnership between Bhaane Group and Topaz Detailing, which aims to establish multiple detailing centers across India.

Innovations and Developments

-

EVOLV launched a new range of Paint Protection Films (PPF) in March 2025, enhancing the appeal of modern vehicles.

-

In January 2025, PressOn Automotive acquired VSM, introducing a new line of automotive wrap films in the UK.

-

In March 2024, Arlon Graphics introduced Vital, a line of eco-friendly non-PVC wrapping films for automotive applications.

Future Outlook

The market is expected to evolve significantly over the next decade. Key opportunities lie in the development of bio-degradable wraps, the rising use of camouflage wraps for military vehicles, and expanding detailing services globally. Consumer demand for customization and enhanced vehicle protection will continue to drive innovation and growth in this dynamic industry.

Source : https://www.towardsautomotive.com/insights/automotive-wrap-films-market-sizing