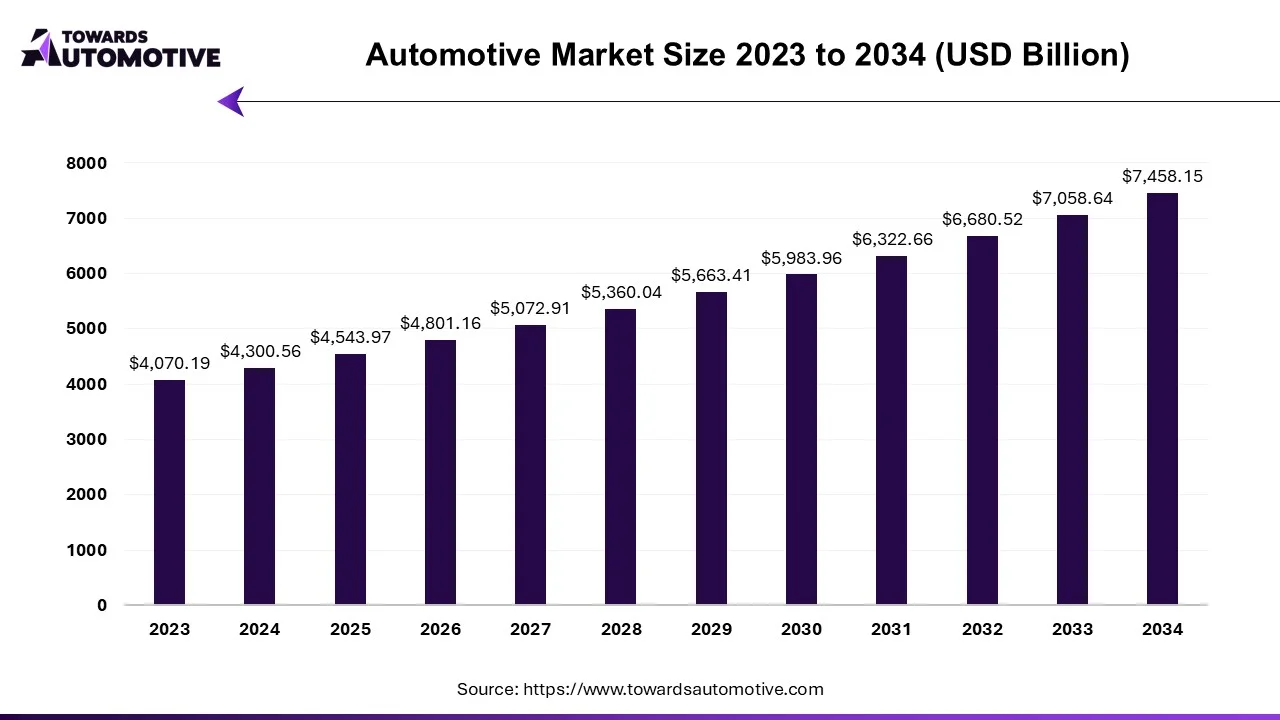

The automotive industry is undergoing a significant transformation, propelled by rapid technological advancements, rising consumer demand, and strong government support for sustainable mobility. In 2024, the industry was valued at USD 4300.56 billion, and it is projected to reach USD 7458.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.66%.

Understanding the Automotive Market

The automotive market includes the manufacturing and distribution of a wide array of vehicles such as passenger cars, commercial vehicles, two-wheelers, and electric vehicles. These vehicles run on different fuel types like gasoline, diesel, electricity, and hydrogen. They are sold via diverse channels—dealerships, direct sales, and online platforms.

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/download-databook/1207

The growing interest in luxury vehicles in developed regions, along with the global shift toward electric mobility, is significantly shaping the market landscape.

Key Market Highlights

-

North America leads the market in terms of revenue.

-

Asia Pacific is set to record the highest CAGR during the forecast period.

-

Passenger cars held the largest market share by vehicle type.

-

Commercial vehicles are projected to witness the fastest growth.

-

Internal combustion engines (ICE) dominated the market by fuel type, although electric vehicles (EVs) are quickly gaining traction.

Top Trends Shaping the Automotive Industry in 2025

1. Strategic Partnerships

Automakers are increasingly forming strategic alliances to accelerate innovation and meet evolving customer preferences. For instance, in June 2025, Faissner Petermeier Fahrzeugtechnik AG partnered with Mullen to introduce the high-performance Mullen FIVE RS EV Crossover to the German market.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-sample/1207

2. Strong Government Support

Governments worldwide are rolling out initiatives to boost electric vehicle adoption. In June 2025, Germany launched a new program aimed at expanding EV use and reducing vehicular emissions nationwide. Similar actions are being taken in India, China, and the U.S.

3. Surging Vehicle Production

Major players are ramping up vehicle production to meet growing global demand. In Brazil alone, nearly 2.5 million vehicles were produced in 2024, according to OICA. Such momentum is expected to continue as companies invest in manufacturing infrastructure.

ICE Dominance in 2025: What’s Driving It?

The internal combustion engine (ICE) segment remains the dominant fuel type in the automotive market. Several factors contribute to this:

-

High demand for diesel-powered vehicles in industries like logistics, e-commerce, and mining.

-

Inadequate EV charging infrastructure in rural and suburban areas.

-

Technological improvements in ICEs offering better performance and fuel efficiency.

-

The popularity of petrol vehicles for their low maintenance and consistent reliability.

For example, Nissan launched the Interstar in February 2024, featuring a powerful 2-liter diesel engine with a towing capacity of 2.5 tons—catering directly to heavy-use consumers.

Accelerated Growth of Electric Vehicles

While ICE remains dominant, electric vehicles are rapidly climbing the ranks:

-

Governments are aggressively promoting EV adoption through subsidies and infrastructure development.

-

Emerging EV startups and legacy automakers alike are investing in new production facilities.

-

Global consumer awareness about climate change and sustainability is increasing demand for EVs.

If you have any questions, please feel free to contact us at sales@towardsautomotive.com

General Motors’ USD 4 billion investment in June 2025 to scale EV production in the U.S. is a prime example of this shift.

Regional Outlook

North America

North America is currently the largest automotive market, driven by high EV adoption in the U.S. and Canada, and increasing demand for luxury vehicles. Key players in the region include Tesla, Rivian, and General Motors.

Asia Pacific

Asia Pacific is expected to be the fastest-growing region. The surge is powered by rising demand for hybrid and electric vehicles, government initiatives to improve EV infrastructure, and increasing production capacity in countries like China, India, and Japan.

A notable development came in March 2025, when BYD launched Dolphin—a fully electric hatchback with a 520 km range—further expanding the region’s EV offerings.

Recent Developments in the Industry

-

Volkswagen introduced the Golf GTI in India in May 2025, featuring premium aesthetics and performance upgrades.

-

Nissan is set to globally launch the Micra EV in late 2025, promising a 408 km range.

-

Mazda unveiled the EZ-60 electric SUV in China in April 2025, offering up to 600 km on a full charge.

Frequently Asked Questions (FAQs)

Q. What is the projected size of the automotive market by 2034?

The market is expected to reach USD 7458.15 billion by 2034, growing from USD 4300.56 billion in 2024 at a CAGR of 5.66%.

Q. Which region is leading the automotive market currently?

North America holds the largest market share in terms of revenue, with strong demand for both luxury and electric vehicles.

Q. What are the major trends in the automotive industry in 2025?

Key trends include strategic partnerships among automakers, government initiatives promoting EVs, and increasing global vehicle production.

Q. Why does the internal combustion engine segment dominate the market?

ICE vehicles are still preferred due to their reliability, strong demand in industrial applications, and lack of EV infrastructure in some areas.

Q. How is Asia Pacific contributing to the growth of the automotive market?

Asia Pacific is the fastest-growing region, supported by rising EV and hybrid demand, government-backed infrastructure, and growing domestic vehicle production.

Source : https://www.towardsautomotive.com/insights/automotive-industry-sizing