Auto loan origination software plays a vital role in streamlining and automating the process of applying for and approving vehicle loans. Used by banks, credit unions, mortgage lenders, and brokers, these tools help financial institutions improve efficiency, assess creditworthiness, and reduce fraud risks. With increasing consumer preference for financing car purchases through loans, the market for this software is witnessing robust global growth.

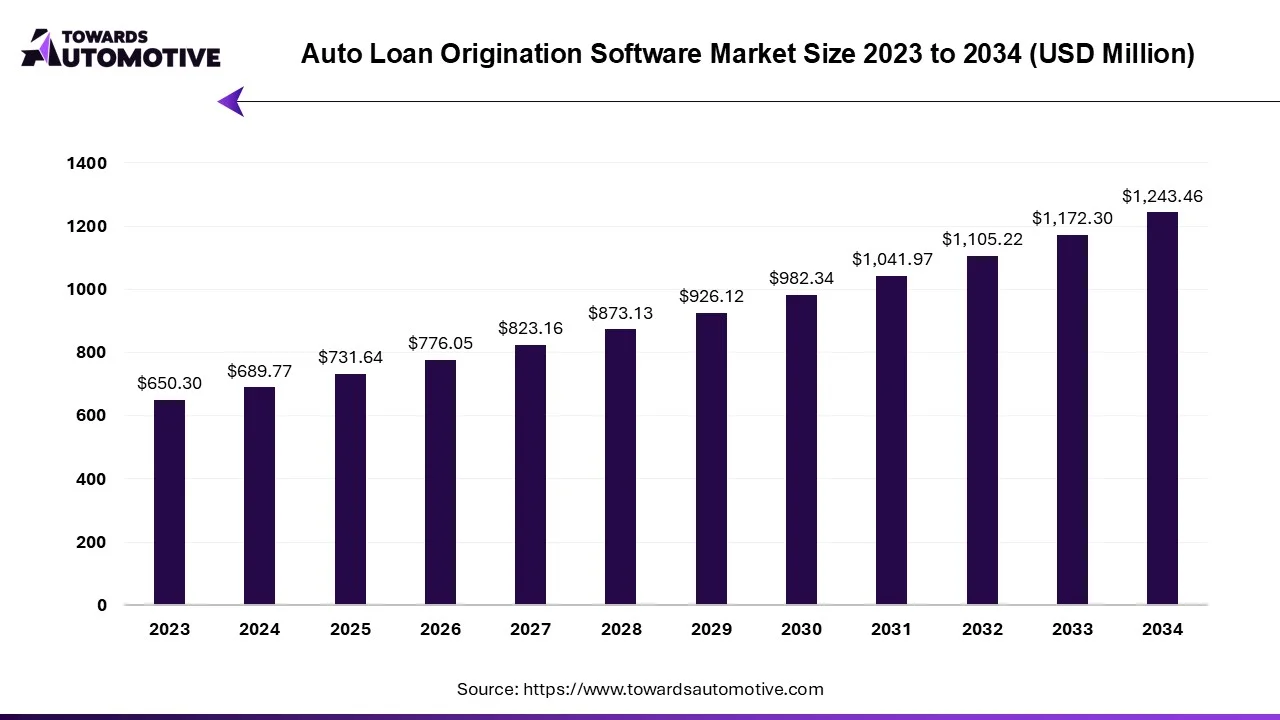

In 2024, the global auto loan origination software market was valued at USD 689.77 million and is expected to reach USD 1,243.46 million by 2034, growing at a CAGR of 6.07%.

Key Market Highlights

-

North America dominated the global market in terms of revenue.

-

Europe is forecast to show the strongest growth rate during the next decade.

-

Software segment leads by component, while services show strong potential.

-

Cloud-based deployment is preferred, but on-premises deployment is also steadily increasing.

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/download-databook/1157

2025 Market Trends: What’s Driving the Growth?

1. Strategic Partnerships

In a significant development, several credit unions have partnered with technology providers to adopt next-generation loan origination platforms. In February 2025, Mantl partnered with credit unions like SouthPoint, Embers, Minnco, and The Atlantic Federal to roll out its software, enhancing automation and efficiency in loan processes.

2. Increase in Vehicle Sales

The booming automotive sector is another key factor. Rising vehicle sales in countries such as India, the U.S., the UK, Germany, and the UAE are creating a higher demand for vehicle loans. For instance, the UK saw 150,070 vehicle registrations in May 2025 alone, boosting demand for origination software.

3. Adoption of AI in Loan Platforms

AI integration is transforming the way loans are processed. In June 2025, Rapid Finance introduced SPADE, an AI-based platform tailored for small banks to enhance credit checks and streamline loan approvals. This reflects a broader trend of AI-powered decision-making in the BFSI industry.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-sample/1157

Component Insights: Why Software Leads the Market

The software segment held the largest market share in 2025. Countries like India, UAE, Malaysia, and Germany are seeing a rise in software startups, which in turn is fueling the development of more advanced platforms for loan origination. The surge in cloud-based deployments and AI-backed software is further contributing to this growth.

Meanwhile, the services segment is poised for strong expansion. The growing preference for SaaS models in banking and the use of automated services for loan evaluation are encouraging banks to subscribe to managed services, increasing recurring revenues for software vendors.

Regional Insights: North America Leads, Europe on the Rise

North America

North America dominated the market thanks to widespread adoption of cloud-based technology in banking and high consumer interest in vehicle financing. Credit unions are offering attractive loan schemes, and regional players such as Black Knight Technologies, Inovatec Systems, Calyx Technology, and ICE Mortgage Technology are playing a pivotal role in pushing innovation.

A notable development includes the February 2025 partnership between Inovatec Systems and Dabadu to co-develop a CRM platform specifically for processing auto loans.

If you have any questions, please feel free to contact us at sales@towardsautomotive.com

Europe

Europe is expected to grow at a strong CAGR through 2034. Rising demand for battery electric vehicles (BEVs) in countries like Germany, Italy, Denmark, and the UK is prompting the adoption of financing platforms. Increased digital banking penetration and support for connected finance solutions are key growth drivers.

Leading European vendors include HES FinTech, Aryza, and SBS Banking Platform.

Recent Developments

-

November 2024: Iron Mountain launched InSight Digital Experience Platform (DXP), a SaaS tool designed to help lenders automate loan applications.

-

April 2024: Odessa introduced “Odessa Auto,” a next-gen origination platform tailored for auto loans.

-

January 2024: Alfa Systems rolled out “Total Originations,” a specialized finance platform for automotive loan processing.

Frequently Asked Questions (FAQs)

1. What is the forecasted size of the global auto loan origination software market by 2034?

The market is projected to grow from USD 689.77 million in 2024 to USD 1,243.46 million by 2034, with a CAGR of 6.07%.

2. Which region led the market in 2025?

North America led the market in terms of revenue, largely due to high adoption of technology and increasing automotive loan penetration.

3. Why is the software segment dominating the market?

The software segment dominates because of increased investments in AI-enabled and cloud-based platforms, along with a rise in fintech startups across multiple regions.

4. How is AI impacting the auto loan origination software industry?

AI enhances credit risk analysis and fraud detection, accelerating loan approvals and improving overall loan processing efficiency.

5. What makes Europe a high-growth region for this market?

Europe’s growth is driven by increasing electric vehicle sales, widespread use of digital banking, and the presence of innovative fintech companies.

Source : https://www.towardsautomotive.com/insights/auto-loan-origination-software-market-sizing