Overview

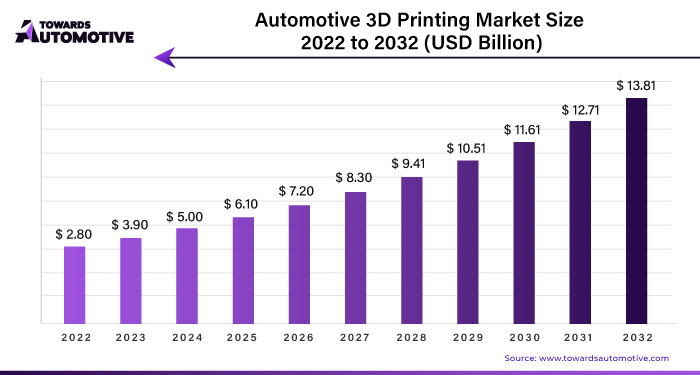

The automotive 3D printing market size is expected to rise from USD 2.8 billion in 2022 to reach an estimated USD 13.81 billion by 2032, increasing at a double digit CAGR of 19.40% between 2023 and 2032.

Take the next leap – click here for more @ https://www.towardsautomotive.com/insights/automotive-3d-printing-market-size

- The primary driver of automotive 3D printing growth is reducing development time and manufacturing costs by minimizing prototypes.

- It’s worth noting the significant role of major OEMs in propelling the automotive 3D printing sector forward. Their considerable expenditures and efforts are a testament to the industry’s potential and a compelling reason for investment.

- In a noteworthy move, Materialise N.V. strategically invested in Ditto, a 3D printing firm, in September 2020. This decision aimed to promote additive manufacturing technology across various sectors, signalling the industry’s growth and potential for diverse applications.

- Long-term automotive trends include:

- Shorter turnaround times

- Less material waste

- Cheaper manufacturing costs

- Higher production rates

- Faster component prototyping through novel printing materials and more government R&D expenditure

- Key automotive 3D printing industry competitors are constantly pursuing collaborations to increase their market positions and gain large contracts with automobile OEMs.

- Stratasys, for example, signed a significant agreement with Toyota Racing Development in June 2022 to become the official 3D printing partner for the Toyota GR Cup Series, using cutting-edge 3D printers like the Fortus 450mc, F370, and new composite F370CR models for car manufacture.

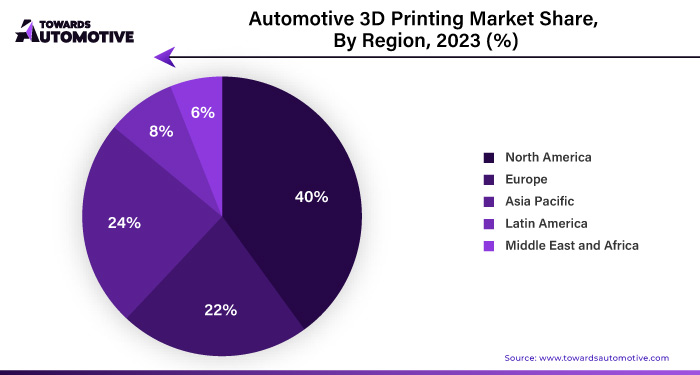

- Geographically, North America dominates the automotive 3D printing market because of the large number of automotive 3D printer manufacturers, extensive acceptance of 3D printing across production, and aggressive initiatives taken by automotive manufacturers to embrace Industry 4.0 applications.

Insights into Automotive 3D Printing Market Trends

This section covers the major market trends shaping the automotive 3D printing market according to our research experts:

Exploring the Surge in Fused Deposition Modeling (FDM) Adoption Across Industries

- The automotive industry faces pressure to find cost-effective solutions amidst rising raw material prices and global economic uncertainties.

- Advancements in additive manufacturing techniques and materials are set to revolutionize 3D printing applications in the automotive sector, creating new opportunities.

- Additive manufacturing, mainly 3D printing, is increasingly crucial for automakers to achieve efficient and successful production outcomes.

- 3D printing for prototyping proves highly cost-efficient and time-saving, addressing key automotive industry challenges.

- Fused Deposition Modelling (FDM) emerges as a widely utilized 3D printing method in the automotive sector, offering versatility in producing prototypes, concept model parts, and final products.

- FDM primarily employs thermoplastic materials, resulting in lightweight finished products suitable for automotive applications.

- Technological advancements in FDM enable the utilization of high-performance engineering-grade thermoplastics, yielding durable and lightweight items.

- FDM’s benefits include minimal waste and a low carbon footprint, driving its widespread adoption across the industry.

- Recent enhancements in FDM technology facilitate the 3D printing of parts using materials like carbon fibre and carbon fibre-reinforced polymers, further enhancing its significance for automakers.

- FDM’s capability to produce carbon fibre vehicle parts reduces manufacturing costs, time, and environmental impact compared to traditional processes.

- The increasing trend in automobile production is expected to significantly boost the adoption of 3D printing in the automotive industry.

- For example, global automotive production reached 80.14 million units in 2021, marking a 3.13% growth compared to 2020, signalling a promising trajectory for adopting 3D printing technology.

US Army-Supported Robot Designs Innovative Shock-Absorbing Structure Using AI

Researchers at Boston University have achieved a breakthrough in 3D-printing technology with an autonomous robot that leverages artificial intelligence (AI) to create advanced shock-absorbing materials. This innovation, funded by the US Army, has led to the development of a unique shape designed to absorb shock in ways previously impossible for human designers.

The project, which has been active for over three years, involved the robot continuously producing more than 25,000 3D-printed structures. These structures, optimized for energy absorption, are being explored for a variety of applications, including safer helmets, improved packaging, and more effective car bumpers.

The core challenge was to design a shape that maximizes mechanical energy absorption efficiency. The autonomous robot used machine learning to navigate this complex task, continuously refining its designs and producing a vast library of structures. This extensive data collection is crucial for applications where efficient energy absorption is critical, such as cushioning for delicate electronics or protective gear for athletes.

According to the researchers, the machine’s output includes a range of shapes that can significantly enhance safety features. For instance, new helmet padding for soldiers is being developed from this data, combining comfort with effective impact protection. The final design includes a softer center and a reduced height to improve comfort without compromising on safety.

The team assessed the energy absorption efficiency of various additively manufactured polymer structures. By employing a self-driving lab (SDL) and Bayesian optimization, they were able to explore over trillions of design possibilities. This collaborative approach between human researchers and the SDL led to the creation of a structure with a remarkable 75.2% energy absorption efficiency. This extensive experimentation has also yielded valuable data, offering insights into designing resilient structures for a range of applications.

Analyzing Market Dynamics in Automotive 3D Printing

DRIVER:

Innovating Together Collaborative Efforts of Major OEMs Drive Automotive 3D Printing Growth

- 3D printing emerges as a low-cost alternative for automobile OEMs, allowing for more efficient car parts production and shorter production times.

- Despite initial obstacles, OEMs report favourable results in manufacturing processes and end products using 3D printing, prompting further investment in the technology.

- Companies make significant R&D investments, promoting technical improvements and driving the growth of the 3D printing market.

- Over the last two decades, advances in 3D printing processes and materials have made it easier to create customized objects.

- Industry giants such as Stratasys (Israel) and 3D Systems (United States) make significant expenditures in 3D printing technology to position themselves competitively.

- Start-ups and small businesses also engage in R&D for automotive 3D printing technology to develop novel solutions.

- Introducing new 3D printing technologies and materials will create diverse application areas and expand 3D printing penetration across industries.

- R&D efforts primarily focus on enhancing and broadening existing technology capabilities, software, and materials for high accuracy and efficiency.

- Companies strive to develop more affordable products and universally compatible, customer-friendly software systems for 3D printing applications.

- These advancements will significantly impact the 3D printing industry from 2020 to 2032, driving further growth and innovation.

RESTRAINT:

Overcoming Material and Standardization Challenges to Drive Automotive 3D Printing Forward

- Overcoming the significant barrier of high material costs could unlock many opportunities in 3D printing. The potential benefits of more affordable 3D printing materials are not limited to cost savings. They promise increased accessibility and democratizing 3D printing technology, a transformative potential that manufacturers, investors, and industry analysts should consider.

- The high prices are due to the high purity, homogeneous composition, and size required for specialised 3D printing techniques.

- Customers are left with no choice but to acquire proprietary materials from large competitors due to the scarcity of 3D printing material providers. This situation results in increased costs and stifles market competition and innovation. It’s a pressing issue that manufacturers and investors must address to foster a more competitive and innovative 3D printing industry.

- Manufacturers’ hesitation to incorporate 3D-printed components in finished goods can be alleviated by developing suitable mechanical material standards. Such standards would provide a reliable framework, instilling confidence in the dependability of 3D-printed objects.

- The lack of standards also compromises the precision and dependability of 3D-printed objects.

- Material selection varies based on the 3D printing process and includes mechanical testing, porosity, powder composition, particle uniformity, distribution, size, and shape.

- The lack of material standardization in 3D printing is a key barrier to industry expansion. Materials frequently fail to fulfil intended criteria, resulting in lower-quality goods. This issue underscores the need for investment in the development of standardized materials, a crucial step that manufacturers and investors can take to drive the growth of the 3D printing industry.

OPPORTUNITY:

Identifying Untapped Opportunities in Adjacent Markets for 3D Printing

- The transition of 3D printing applications from fast prototyping to direct digital manufacture (DDM) of items has prompted interest in future applications in various industries, including healthcare, consumer products, and automobiles.

- 3D printing has great economic potential and is expected to influence various industries, including aerospace and medicine substantially.

- The future offers the potential for more personalized and sophisticated 3D printing applications, ushering in a new era of creativity and efficiency.

CHALLENGE:

Manufacturers’ Legal Tactics in IPR and Copyright Disputes

- 3D printing, an innovative technique, holds the potential to bring about a revolution in industrial manufacturing. It can be printed in varied forms using many materials, such as polymers, metals, ceramics, and even live tissue. This technology could transform production lines, enabling faster production, reducing waste, and allowing for greater customization.

- However, concerns concerning 3D printing’s conformity with existing intellectual property and copyright restrictions are expressed, comparable to the problems encountered by prior high-potential technologies such as computing and the internet.

- The Digital Millennium Copyright Act (DMCA) aims to establish a legal framework for 3D printing to avoid breaches and infringements that might hurt both makers/users and copyright/patent holders.

- The poor adoption of personal printers and the consumer market for 3D printing can be primarily attributable to high equipment costs and resource scarcity. However, these costs will likely fall as technology advances and economies of scale emerge.

- Additionally, research is being conducted to discover more affordable and abundant materials for 3D printing. Nonetheless, continuous R&D efforts are pushing affordability, projected to accelerate portable printer use shortly.

- 3D printing uses digital blueprint files (CAD files) to build items layer by layer, with hundreds of designs available on various websites, providing a challenge to patent holders.

- Ongoing arguments aim to address the possible impact of 3D printing on intellectual property rights (IPR), such as whether duplicating patented components at home for personal use is infringement.

Dominance Forecasted for Prototyping and Tooling to Lead Automotive 3D Printing Market

- The prototyping and tooling sector is projected to dominate the market share, with steady growth expected to continue into the future.

- This category’s prominence is attributed to several factors, including rapid prototype manufacturing, simplified procedures, cost efficiency, the wide range of filaments available, flexibility for design modifications, and reduced waste.

- Compared to traditional methods, modern prototypes require the shortest possible lead times and minimal expenditure and waste.

- With only a final CAD design needed for printing, design changes can be made at any stage of the process.

- The availability of multiple filament materials allows for the creation of prototypes with diverse material properties, tested under various criteria and settings.

North America Poised for Dominance in the Automotive 3D Printing Market

- North America currently holds the largest market share in the automotive 3D printing industry, followed by Europe and Asia-Pacific, mainly due to early technology adoption.

- The dominance of North America and Europe is fuelled by significant investments in research & development by OEM manufacturers, aiming to produce customized automotive parts and streamline production processes.

- For instance, In December 2021, BMW i Ventures provided seed capital to Rapid Liquid Print (RLP), a start-up utilizing gel dispensing technology licensed from MIT’s Self Assembly Lab for producing soft, pliable automotive products.

- Falling 3D printer prices are expected to accelerate automotive 3D printing adoption in critical manufacturing regions like Europe and Asia-Pacific, surpassing North America’s growth rate in the forecast period.

- Asia-Pacific is poised for healthy growth in the automotive 3D printing market due to factors such as start-up activity, a developed chemical industry, government initiatives, skilled labour availability, and access to low-cost raw materials.

- North America is projected to maintain its dominance in the global 3D printing market in 2022, driven by ongoing technological advancements and the presence of numerous carmakers in the region.

- Europe is expected to be the fastest-growing 3D printing market, particularly in automotive R&D applications such as prototyping and fixtures, leveraging the cost-effectiveness of additive manufacturing.

- The US is forecasted to lead the North American automotive 3D printing market, supported by significant production of both ICE and electric vehicles, driving demand for 3D-printed parts, especially in plastic additive manufacturing for components like interior trims and dashboards.

A Deep Dive into the Automotive 3D Printing Industry

- Active and competitive market with both start-ups and established companies.

- Pioneering companies invest in technical research to push boundaries and build high-quality products.

- Firms use partnerships, mergers, and acquisitions to strengthen market position.

- Materialise N.V. announced seven new partners for its CO-AM platform in November 2022.

- Stratasys Ltd. bought Riven in October 2022, integrating Riven’s cloud-based solution with GrabCAD 3D printer.

- Brose invested in its first VX1000 HSS in October 2021.

Recent Developments

Renishaw’s RenAM 500 3D Printing Machinery Series

- Launched in May 2022, featuring simplified powder handling systems for R&D, pre-production, or bureau environments.

3D Systems’ Acquisition of Titan Additive LLC

- Expanded solution portfolio in February 2022.

Materialise’s Qualified Supplier Status with Airbus

- Made first qualified suppliers under Airbus Process Specification AIPS 03-07-022.

Stratasys’ New 3D Printers

- Introduced Origin One, H350, and F770, suitable for various industries, including automotive.

Porsche’s 3D-Printed Seats and Desktop Metal’s Orders

- Porsche introduced 3D-printed seats in 2020, customizable to customer specifications.

- Desktop Metal secured a $9 million order for binder jet additive manufacturing systems in November 2022.

- 3D Systems partnered with ALM in November 2022 to expand 3D printing materials.

Stratasys Ltd. Merger with Ultimaker

- Stratasys Ltd. merged MakerBot with Ultimaker in September 2022.

- Materialise N.V. acquired Identify3D in September 2022 for secure digital part distribution software.

Stratasys Ltd. Acquisition of Covestro AG’s Additive Materials Manufacturing Business

- Stratasys Ltd. acquired Covestro AG’s additive materials manufacturing business in August 2022.

Voxeljet AG’s Sale-Leaseback Agreement

- Voxeljet AG entered a sale-leaseback agreement in August 2022, generating EUR 26.5 million in gross proceeds.

Automotive 3D Printing Market Leaders

- Stratasys Ltd.

- The Exone Company

- Materialise NV

- Ultimaker BV

- Arcam AB

- Voxeljet AG

- Höganäs AB

- 3D Systems Corporation

- Envisiontec GmbH

- EOS GmbH

- Moog Inc.

Study thoroughly: https://automotivewebwire.com/insights/passenger-car-bearing-and-clutch-component-aftermarket-insight/

Explore the comprehensive statistics and insights on automotive industry data and its associated segmentation: https://www.towardsautomotive.com/get-an-annual-membership

To own our research study instantly, Click here @ https://www.towardsautomotive.com/price/1002

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive