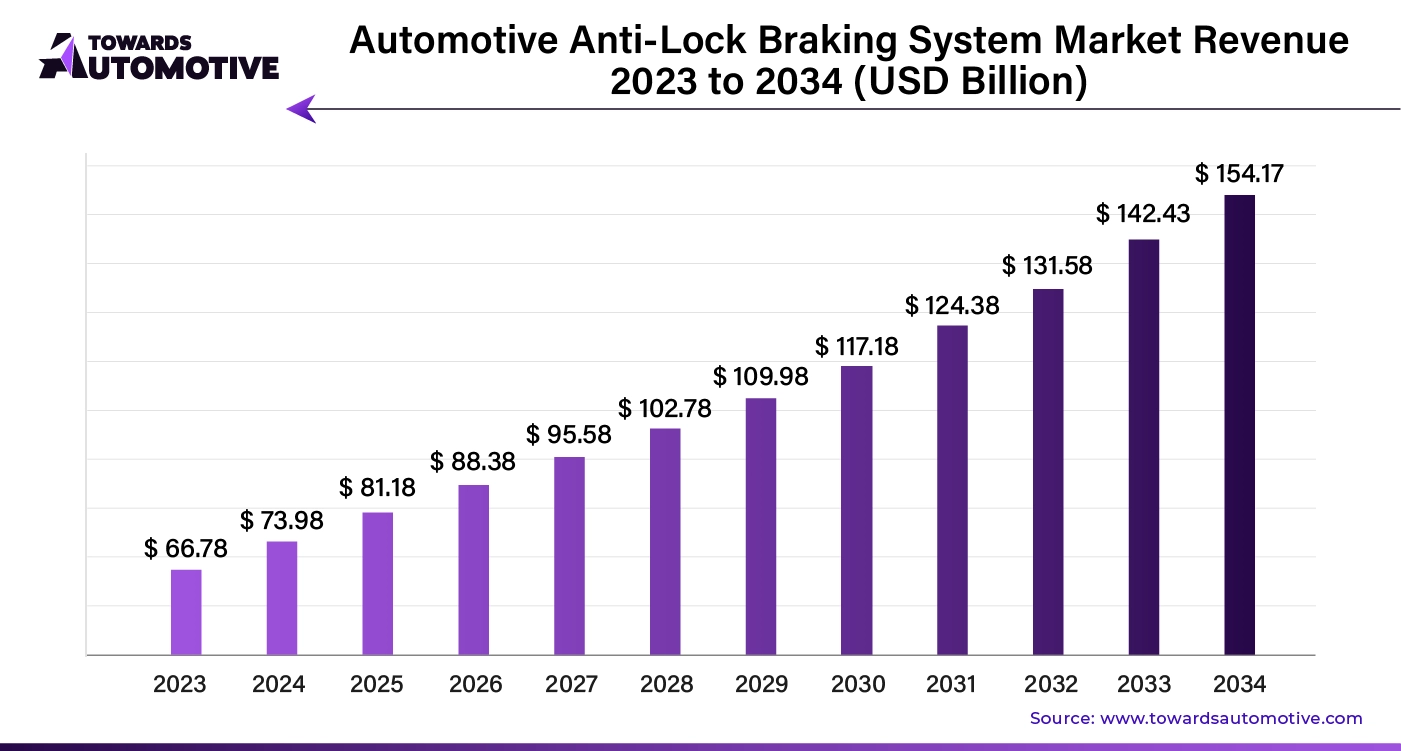

The global automotive anti-lock braking system (ABS) market is on a steady growth trajectory, with the market size expected to grow from USD 73.98 billion in 2024 to USD 154.17 billion by 2034, expanding at a compound annual growth rate (CAGR) of 9%. This robust growth is driven by increasing safety concerns, technological innovations, and the growing adoption of electric vehicles (EVs), among other factors. In this article, we delve into the regional insights, growth drivers, and recent developments shaping the automotive ABS market.

Get All the Details in Our Solution – Download Brochure @ https://www.towardsautomotive.com/download-brochure/1005

Regional Insights

Asia Pacific: The Dominant Force in the ABS Market

Asia Pacific currently dominates the automotive anti-lock braking system market and is set to maintain its strong position in the coming years. The region is experiencing substantial growth, largely due to a surge in vehicle production, the rapid expansion of electric vehicles (EVs), and stringent government regulations that prioritize safety. Countries like China, India, and Japan—home to some of the world’s largest automotive manufacturing hubs—are seeing a notable increase in vehicle output, which in turn drives demand for ABS.

The rising adoption of electric vehicles is another key factor propelling the market forward. EVs, with their unique handling characteristics, necessitate enhanced braking systems like ABS to ensure optimal safety. As the global demand for EVs continues to rise, manufacturers are prioritizing the integration of ABS to meet safety standards and improve braking performance.

Additionally, governments in Asia Pacific are playing a critical role by mandating ABS inclusion in vehicles, including motorcycles and entry-level cars. China and India, in particular, have introduced laws that require ABS installation, further driving its widespread adoption. The combination of vehicle production growth, EV expansion, and regulatory push ensures that Asia Pacific will continue to be a dominant player in the global ABS market.

Europe: Leading with Technological Innovation

Europe is expected to experience the highest compound annual growth rate (CAGR) in the automotive ABS market during the forecast period. Several factors contribute to this anticipated growth, including technological advancements, the increasing demand for luxury and high-performance vehicles, and a heightened focus on road safety.

Europe has long been known for its innovation in the automotive sector. Continuous advancements in ABS technology are improving its integration with other essential safety systems, such as electronic stability control (ESC) and traction control. These innovations enhance vehicle stability and braking performance, meeting the rising expectations of consumers and regulators alike.

The growing demand for luxury and high-performance vehicles is another significant factor propelling the ABS market in Europe. Premium vehicles, which often come equipped with advanced safety features like ABS, are becoming more popular as consumers prioritize both performance and safety. As this trend continues, the adoption of ABS technology is expected to rise significantly.

Furthermore, Europe’s stringent safety regulations and the public’s increasing awareness of road safety are contributing to the widespread implementation of ABS. In March 2023, the European Union introduced a mandate requiring ABS in motorcycles under 125cc, a move that is expected to further expand the market.

Market Trends and Growth Drivers

The global automotive anti-lock braking system market is growing due to several key trends:

- Technological Advancements: Continuous improvements in ABS technology, including the integration with electronic stability control (ESC) and traction control systems, are enhancing the overall braking performance and vehicle stability.

- Electric Vehicle (EV) Growth: The rise of electric vehicles, which have unique braking requirements, is driving manufacturers to prioritize ABS integration for improved safety in EVs.

- Government Regulations: Increasing government regulations and safety standards are mandating the inclusion of ABS in various vehicle categories, including motorcycles and entry-level cars, accelerating its adoption.

- Focus on Safety: As consumers and regulatory bodies place greater emphasis on vehicle safety, ABS has become a standard feature in many regions, further driving its demand.

Recent Developments in the ABS Market

The automotive ABS market continues to evolve, with several notable developments from key players in the industry:

- Itelma LLC’s New Manufacturing Unit: In July 2023, Itelma LLC opened a new manufacturing facility in Kostroma, Russia, dedicated to producing ABS systems for automotive applications. This expansion reflects the company’s commitment to meeting the growing demand for ABS systems globally.

- Continental’s ABS Launch in India: In January 2024, Continental launched a new ABS system tailored for 125cc to 200cc vehicles in India. This new system aims to enhance safety in the rapidly expanding Indian motorcycle market.

- Bosch’s ABS System for E-Bikes: Bosch introduced a new ABS system for e-bikes in Germany in July 2022. This system is designed to improve safety in electric bicycles, highlighting the growing need for advanced braking systems in electric mobility solutions.

Invest in Our Premium Strategic Solution @ https://www.towardsautomotive.com/price/1005

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Explore the comprehensive statistics and insights on automotive industry data and its associated segmentation: Get a Subscription

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive