Overview

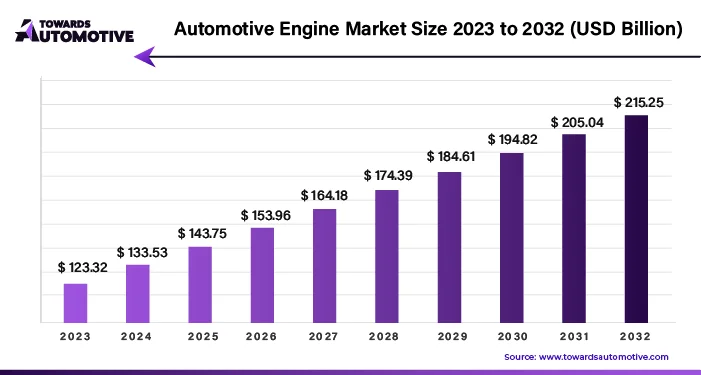

The automotive engine market was valued at USD 123.32 billion and is anticipated to surpass USD 215.25 billion by 2032, growing at 6.53% CAGR from 2023 to 2032.

Download a sample version of this report @ https://www.towardsautomotive.com/download-statistics/1082

The onset of the COVID-19 pandemic had an immediate and significant impact on the global automotive industry. Measures such as quarantine protocols and international travel restrictions led to the closure of auto parts factories and a decline in customer footfall in showrooms worldwide.

Despite these challenges, the automotive engine market is expected to experience robust growth in the coming years. Key drivers of this growth include the adoption of new technologies, particularly engine management systems, aimed at enhancing vehicle lifespan and overall engine performance. Additionally, increasing demand for fuel-efficient and lightweight vehicles is poised to generate substantial returns for investors in the forecast period.

Furthermore, the rise of electric vehicles (EVs) is reshaping the automotive landscape, leading to the potential closure of traditional engine production facilities by original equipment manufacturers (OEMs). For instance, Stellantis announced the closure of its Fiat Powertrain Technologies (FPT) engine plant in Camporago, Brazil, as part of its transition towards achieving zero emissions by 2038.

Asia Pacific is expected to remain a pivotal market for automotive transportation throughout the forecast period. Leading the global automotive engine market are regions like North America and Asia-Pacific, driven by stringent environmental standards and regulations in markets such as North America, Europe, and Asia-Pacific.

The automotive engine market is poised for significant expansion, propelled by technological advancements, evolving consumer preferences, and regulatory shifts towards sustainability and emission reduction.

Automotive Engine Market Trends

Increasing Investment and Vehicle Sales to Provide Momentum

The automotive engine industry is being propelled forward by the advancement of new technologies like variable displacement engines (VDE) and hybrid engines. Manufacturers are innovating to create systems such as hybrids and VDEs, which offer both high performance and fuel efficiency.

To stay competitive, automobile manufacturers are focusing on producing engines that are both powerful and compact. This trend towards engine downsizing aims to reduce vehicle weight and emissions while maintaining or enhancing power output. The growing demand for cars further fuels the need for engines, as evidenced by recent sales trends:

- In the United Kingdom, diesel car sales declined by 9.7% in October 2022 compared to the previous year, while sales of gasoline engine vehicles increased significantly. Sales of hybrid and electric vehicles also saw notable growth, indicating a shift towards more fuel-efficient options.

- In Germany, gasoline cars accounted for 37.1% of the market in 2021, followed closely by hybrid vehicles at 28.8%. The increasing market share of electric and hybrid vehicles signals a rising demand for alternative fuel options.

To meet the expanding demand for gasoline and diesel engines, manufacturers are scaling up their production capacities:

- French automotive giant Groupe Renault has announced plans to focus on internal combustion engine production in collaboration with Geely Holding. This initiative includes setting up a production unit for combustion engine vehicles and small hybrid cars, as well as supplying electrical components and internal combustion engines.

- Toyota has invested $383 million in its US factories to support the production of four-cylinder vehicles, including hybrid electric models. Additionally, the company’s Huntsville, Alabama plant will undergo expansion to accommodate the production of combustion engines and hybrid electric powertrains.

With these developments and the ongoing demand for automobiles, the automotive engine industry is expected to continue thriving in the forecast period, driven by increasing vehicle sales and the adoption of new fuel-efficient technologies.

Automotive Engine Market Leaders

- Mercedes-Benz

- Cummins Inc.

- Toyota Motor Corporation

- BMW

- General Motors

- Honda Motor Company Ltd

- Hyundai Motor Company

- Scania AB

- Suzuki Motor Corporation

- Mazda Motor Corporation

- Volkswagen AG

- Eicher Motors Limited

- Yamaha Corporation

- Fiat Automobiles SpA

Automotive Engine Market Recent Developments

- January 2024: General Motors announced the launch of its next-generation Ecotec engine family, featuring turbocharged gasoline and diesel variants. The new engines are designed to deliver enhanced fuel efficiency, lower emissions, and improved power delivery across a range of vehicle applications, from compact cars to light-duty trucks.

- February 2024: Volkswagen Group introduced its latest generation of TDI diesel engines, equipped with advanced exhaust gas treatment systems to meet the latest emissions standards. The new engines boast improved performance and reduced fuel consumption compared to previous models, positioning Volkswagen as a leader in clean diesel technology.

- March 2024: Ford Motor Company revealed its latest EcoBoost engine lineup, incorporating hybrid-electric powertrain technology for enhanced efficiency and performance. The new engines feature integrated electric motors and regenerative braking systems, offering seamless transition between gasoline and electric propulsion for improved driving dynamics.

- December 2023: Toyota Motor Corporation unveiled its latest hydrogen fuel cell engine technology, promising improved efficiency and performance for its upcoming lineup of fuel cell electric vehicles (FCEVs). The new engine design incorporates advanced materials and optimized combustion processes to enhance power output while reducing emissions.

- October 2022: General Motors Brazil unveiled plans to expand its facility in Joinville. This expansion aims to enhance production capacity, enabling the company to export engines and contribute to the launch of the 2023 Montana model, which will be assembled at its San Caetano do Sul factory.

- March 2022: Saw Harbin Dongan Automobile Engine Co., Ltd., in collaboration with Changhang Aviation Co., Ltd., announce its investment plan for 2022. The plan includes the establishment of a high-performance continuous-multiple engine production line. The project involves the setup of machining centers equipped with various equipment such as drawing machines, extrusion machines, and glue coating machines. Harbin Dongan Automobile Engine Manufacturing Co., Ltd., a subsidiary of Harbin Dongan Automotive Engine Co., Ltd., will oversee project management, with a total capital investment of 72.33 million yuan ($10.38 million).

- April 2021: MAN Energy Solutions revealed the AmmoniaMot project, a collaboration with LMU, Neptun Ship Design, WTZ, and Woodward L’Orange. Supported by the German Federal Ministry for Economic Affairs and Technology (BMWi), the project aims to develop a dual medium-speed generator capable of operating on both diesel and ammonia.

Automotive Engine Industry Segmentation

The automotive engine serves as the core power source within a vehicle, often referred to as its “power room.” These engines, encompassing both gasoline and diesel variants, harness the energy generated through combustion to drive the vehicle’s electrical systems and propel it forward.

The automotive engine market is categorized based on several key factors, including layout type (such as inline, W engine, and V type), vehicle type (including passenger and commercial vehicles), fuel type (gasoline and diesel), and geographical regions (North America, Europe, Asia Pacific, and the rest of the world). Market reports provide comprehensive estimates of the automotive engine market’s size and value, measured in US dollars (USD) billions, across these various segments.

This segmentation enables a detailed analysis of the automotive engine industry, allowing stakeholders to understand market dynamics, identify growth opportunities, and make informed decisions regarding investment, product development, and strategic partnerships. By examining factors such as engine layout, vehicle type, and fuel preference, industry participants can tailor their offerings to meet the specific needs and preferences of target markets, driving competitiveness and profitability in the global automotive engine sector.

Market Segmentation

By Placement Type

- In-line Engine

- W Engine

- V-Type

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Fuel Type

- Gasoline

- Diesel

- Other Fuel Types

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

- South Africa

- Rest of Middle-East and Africa

Explore in-depth: https://automotivewebwire.com/insights/automotive-composites-market/

Explore the comprehensive statistics and insights on automotive industry data and its associated segmentation: https://www.towardsautomotive.com/get-an-annual-membership

To own our research study instantly, Click here @ https://www.towardsautomotive.com/price/1082

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive