Government Initiatives Drive Market Growth in Clean Energy

- Initiatives by governments worldwide to opt for green energy to limit and reduce pollution in vehicles are the key factors that will drive the fuel-electric vehicle market in the future. Governments in many countries worldwide have developed plans to encourage fuel-cell electric vehicles (FCEVs) to hit the roads. This will also help improve fuel economy.

- In February 2022, Japan’s Ministry of Environment announced that it will support local governments and enterprises in establishing a common hydrogen market. The ministry used a hydrogen platform in partnership with some companies and local governments that could produce low carbon for use in the region. The goal is implementing the hydrogen platform after the attack across Japan around 2030.

- In February 2022, India’s Ministry of New and Renewable Energy announced that the “Renewable Energy Research and Technology Development” scheme will be used to support research. All aspects of renewable energy, especially the transport of hydrogen and fuel cells. The agency listed some significant improvements. The Indian Institute of Science (IISc) has created a plant to produce high-purity hydrogen from biomass gasification. The International Center for Advanced Research in Powder Metallurgy and New Materials (ARCI) Fuel Cell Technology Center is building an integrated production line for 20 kW PEM fuel cell stacks.

- In January 2022, the German government announced its support vehicle, the CryoTRUCK project. IABG support experts and the Technical University of Munich jointly developed the CRYOGAS hydrogen tank and refueling system for long-distance hydrogen transportation. The three-and-a-half-year CryoTRUCK project, with a budget of more than 25 million Euros, will develop and introduce the first battery technology with compressed air hydrogen (CRYOGAS) storage and refueling system for heavy fuel.

- These initiatives are moving the market forward by increasing the use of fuel cells in transportation. However, the biggest obstacle to the widespread use of gas-powered vehicles in the global market is the lack of hydrogen infrastructure. The reason hydrogen refueling stations worldwide is that N requires high investment and traditional production methods, resulting in high emission levels and making compliance with strict energy policies difficult.

- Building a new hydrogenation infrastructure is expensive (but not more costly than methanol or ethanol infrastructure). Hydrogen produced from natural gas is cheaper than gasoline. Without low-cost electricity or solar panels, water hydrolysis produces hydrogen, and electricity is more expensive than gasoline using conventional methods.

Europe Expected to Witness High Growth Rate

Download a sample version of this report @ https://www.towardsautomotive.com/download-statistics/1015

- The EU plans to reduce greenhouse gas (GHG) emissions from transportation. Therefore, some European countries have decided to use new technologies such as fuel cells (proton exchange membrane fuel cells only) to achieve these goals. This will offer significant opportunities to fuel cell manufacturers entering the market in the future.

- More than 30% of the hydrogen investment demanded worldwide (approximately 76 billion dollars) is in Europe, there are approximately 314 project proposals in total and 268 of them are aimed to be fully or partially commissioned by 2030.

- The European Union (EU) has announced some of the world’s strictest energy efficiency standards in a bid to reduce used vehicle fuel use and encourage the use of diverse vehicles in the region. These emission standards should guide the market and automakers towards zero-emission vehicles.

- Many projects have been initiated to find and develop appropriate solutions to the problem of vehicle emissions. For example, major projects supported by the EU include the H2BusEurope programme, which involves the deployment of 1,000 hydrogen buses and infrastructure, and the JIVE and JIVE 2 projects, which will support around 300 electric buses in 22 European cities (FCEBs). partly with a €32 million grant from FCH JU (Fuel Cells and Hydrogen Joint Unit) under the EU’s Horizon 2020 research and innovation. The working group has 22 members from seven different countries.

- Additionally, business enterprises adopt strategies such as new product development, partnerships, contracts and agreements to manage their business.

- For example, In September 2022, Hyundai Motor Company and Iveco Group launched the first Iveco eDAILY fuel cell electric vehicle at the 2022 IAA Transport Congress in Hanover. The two companies launched a hydrogen-powered Iveco bus with a modern electric motor in July. The eDAILY Fuel Cell Electric Vehicle (FCEV) embodies the future potential of IVECO’s best-selling and longest-running truck.

- Additionally, the development of hydrogen technology in the region will help the economy grow.

For example:

- In March 2022, Cummins Inc. announced the completion of its new hydrogen fuel cell system production facility in Herten, Germany. This significant development is expected to strengthen the company’s efforts to expand its energy solutions and promote the use of hydrogen technology across Europe. The facility will have an initial production capacity of 10 MW per year for fuel cell system engineering and assembly.

- Companies operating in the region are constantly working on research for new materials and new fuel technologies. They are also spending money to expand their facilities. This trend is expected to continue in the coming years, as some companies indicate their focus on fuel cell technology by announcing future investments.

Automotive Fuel Cell System Industry Overview

- Hydrogenics, Ballard Power Systems, Doosan Fuel Cell, and Nedstack Fuel Cell Technology BV are all using innovative technology in the electric car market to grow their businesses and achieve a competitive advantage.

- In February 2023, Doosan Fuel Cell signed a collaboration agreement with the Government of South Australia and Doosan Corporation’s HyAxiom. According to the agreement, South Australia and Doosan Fuel Cell aim to “share tools and knowledge for the development of environmentally friendly fuel cells and energy products, ensuring worldwide competitiveness in hydrogen exports through cooperation in the development of ideas and technologies” and “to demonstrate the best results”.

- In July 2022, IVECO Group, through the IVECO BUS brand, announced that it will collaborate with HTWO to prepare the future European hydrogen-powered bus with the world’s leading fuel cell system. HTWO, the electric fuel-based hydrogen energy business of Hyundai Motor Group, was launched for the first time in December 2020. was also launched, demonstrating Hyundai Motor’s firm commitment to the hydrogen business. With proven fuel cell technology used in modern FCEVs, HTWO expands the availability of fuel cell technology to other automotive OEMs and non-automotive industries, making hydrogen available to everyone.

Automotive Fuel Cell System Market Leaders

- BorgWarner Inc.

- Nuvera Fuel Cells LLC

- Ballard Power Systems Inc.

- Hydrogenics (Cummins Inc.)

- Nedstack Fuel Cell Technology BV

- Oorja Corporation

- Plug Power Inc.

- SFC Energy AG

- Watt Fuel Cell Corporation

- Doosan Fuel Cell Co. Ltd

Automotive Fuel Cell System Industry Segmentation

- Automotive fuel cell systems utilize hydrogen and oxygen to generate electricity via an electrochemical process, offering a clean and sustainable transportation solution by emitting only water vapor.

- Challenges in the automotive fuel cell market include addressing hydrogen infrastructure for widespread adoption, as well as concerns related to cost and durability.

- The market is segmented into four types: polymer electrolyte membrane fuel cells, alkaline fuel cells, direct methanol fuel cells, and phosphoric acid fuel cells.

- The segmentation is based on acid fuel cell, vehicle type that could be passenger and commercial, fuel type that is hydrogen and methanol, and power output categories which is less than 100 kW, 100-200 kW, and more than 200 kW.

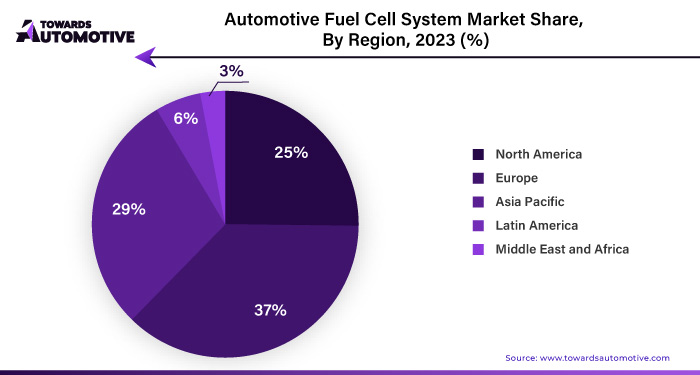

- Geographically, the market is divided into regions including North America, Europe, Asia-Pacific, South America, the Middle East, and Africa.

Market Segmentation

By Electrolyte Type

- Polymer Electronic Membrane Fuel Cell

- Direct Methanol Fuel Cell

- Alkaline Fuel Cell

- Phosphoric Acid Fuel Cell

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Fuel Type

- Hydrogen

- Methanol

By Power Output

- Below 100 KW

- 100-200 KW

- Above 200 KW

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle-East and Africa

- United Arab Emirates

- Saudi Arabia

- Rest of Middle-East and Africa

Explore the comprehensive statistics and insights on automotive industry data and its associated segmentation: https://www.towardsautomotive.com/get-an-annual-membership

To own our research study instantly, Click here @ https://www.towardsautomotive.com/price/1015

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive