The Class 4 truck market is evolving rapidly, playing a pivotal role in the global commercial vehicle industry. These medium-duty trucks, known for their versatility and reliability, are increasingly being adopted across various applications, from logistics and construction to municipal services. In 2025, the market is poised for significant growth driven by technological innovation, regional expansions, and increased demand across industries.

Market Overview

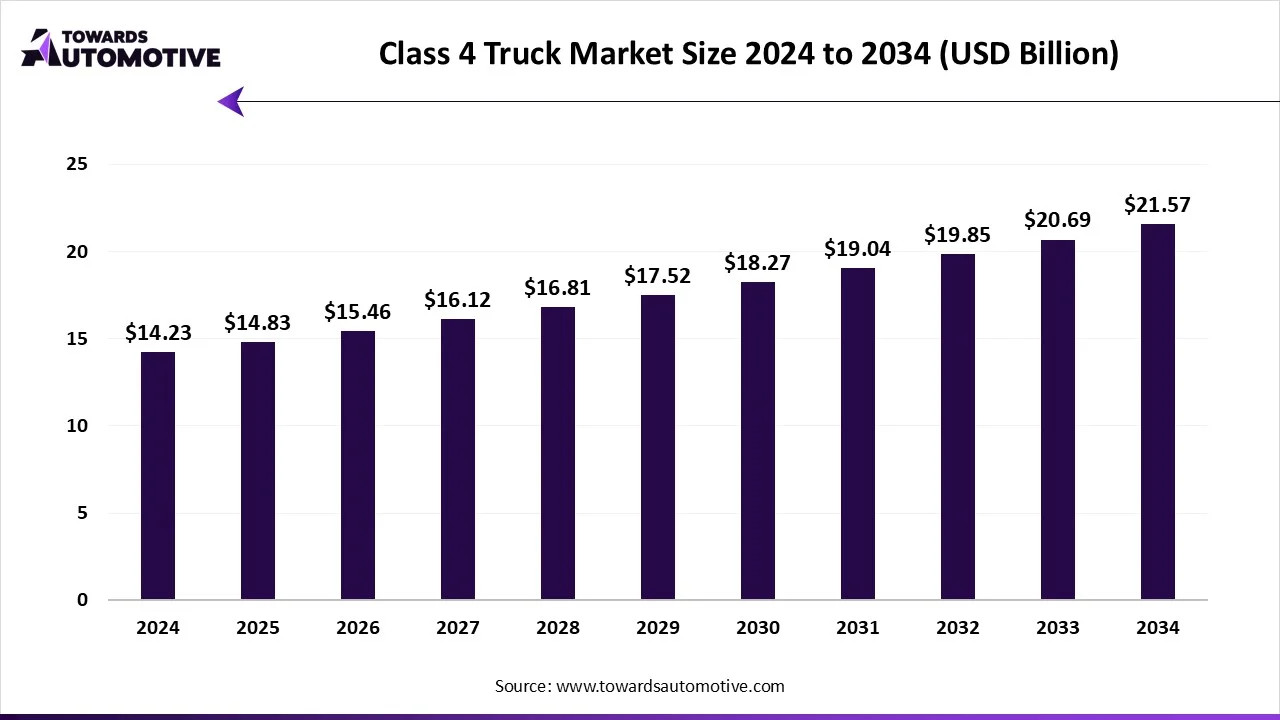

According to projections, the global Class 4 truck market is expected to expand from USD 14.23 billion in 2024 to USD 21.57 billion by 2034, achieving a compound annual growth rate (CAGR) of 4.25%. This impressive trajectory reflects the growing demand for medium-duty trucks capable of balancing payload capacity and maneuverability.

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/download-databook/1758

Class 4 trucks include vehicle types such as dry vans, flatbeds, refrigerated vans, dump trucks, and box trucks. These trucks are powered by a range of propulsion technologies including diesel, gasoline, and electric systems.

Regional Market Insights

North America Leads in Revenue Generation

North America remains the dominant player in the Class 4 truck market, largely due to a mature transportation infrastructure and widespread adoption in the logistics and e-commerce sectors. The United States, in particular, is spearheading innovations in electric and hybrid truck technologies.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-sample/1758

Asia Pacific to Witness Robust Growth

The Asia Pacific region is projected to grow at a notable CAGR during the forecast period. Countries like China, India, Japan, and South Korea are witnessing a surge in demand due to expanding truck fleet operations and increasing investments in electric truck production. Manufacturers like Dongfeng and Changan Automobile Group are strengthening their regional presence, as evidenced by Changan’s new commercial vehicle plant inaugurated in Thailand in May 2025.

Key Market Trends in 2025

Business Expansion Initiatives

Truck manufacturers are expanding their global footprint by establishing new production facilities. For instance, Dongfeng Motor opened a commercial vehicle center in Kyrgyzstan in March 2025 to supply trucks across Central Asia, enhancing its regional influence and supply chain capabilities.

Rise of AI-Based Fleet Management

The trucking industry is rapidly adopting AI-based platforms for route optimization, real-time tracking, and operational efficiency. In January 2024, RXO introduced an AI-powered check-in system for truck fleets, significantly improving logistics workflows across warehouses and distribution centers.

If you have any questions, please feel free to contact us at sales@towardsautomotive.com

Booming E-commerce Industry

The growth of the e-commerce sector has had a profound impact on the Class 4 truck market. These trucks are increasingly used to bridge the last-mile delivery gap between warehouses and end-users, particularly in urban and suburban areas.

Application Insights

General Delivery Dominates the Market

General delivery is the largest application segment in 2025. Electrification of Class 4 trucks for urban deliveries and the expansion of e-commerce logistics networks have bolstered this segment. Partnerships between vehicle manufacturers and logistics providers to develop fuel-efficient, environmentally friendly trucks are driving this trend.

Construction Segment Poised for Fastest Growth

The construction industry is expected to exhibit the highest CAGR. With rising urban infrastructure projects in the U.S., India, and China, the demand for rugged and reliable trucks is surging. Electric truck developers are increasingly focusing on features tailored for the construction sector, including improved payload handling and energy efficiency.

Body Type Insights

Dry Vans Hold the Largest Market Share

Dry vans are the leading body type in 2025, primarily due to their versatility in transporting general goods, electronics, and garments. Their enclosed structure makes them suitable for e-commerce logistics and even hazardous material transport in certain industries.

The increased use of dry vans by logistics firms and growing investment in production facilities have further strengthened this segment’s market presence.

Dump Trucks Set for High Growth

The dump truck segment is gaining momentum, especially in construction and mining operations. The adoption of electric dump trucks for eco-friendly material transport and the use of articulated dump trucks for handling aggregates like gravel, sand, and cement are major drivers.

Municipal applications such as waste management are also contributing to the increased deployment of Class 4 dump trucks.

Competitive Landscape and Recent Developments

The market is witnessing a wave of product launches and technological innovations:

-

The Shyft Group, Inc. introduced the Blue Arc Class 4 electric truck in December 2024 to enhance North American logistics services.

-

Bollinger launched a Class 4 commercial EV with a 158-kWh battery in August 2024, offering extended driving range.

-

Rizon debuted a new line of Class 4 electric trucks tailored for Canadian consumers in April 2024.

These developments indicate an industry-wide shift toward electrification and customer-focused design.

Final Thoughts

The Class 4 truck market is a vibrant segment of the automotive landscape, driven by innovation, regional diversification, and changing consumer demands. As electric and hybrid technologies become mainstream and global logistics needs grow more complex, Class 4 trucks will continue to play a key role in shaping the future of commercial transportation.

Source : https://www.towardsautomotive.com/insights/class-4-truck-market-sizing