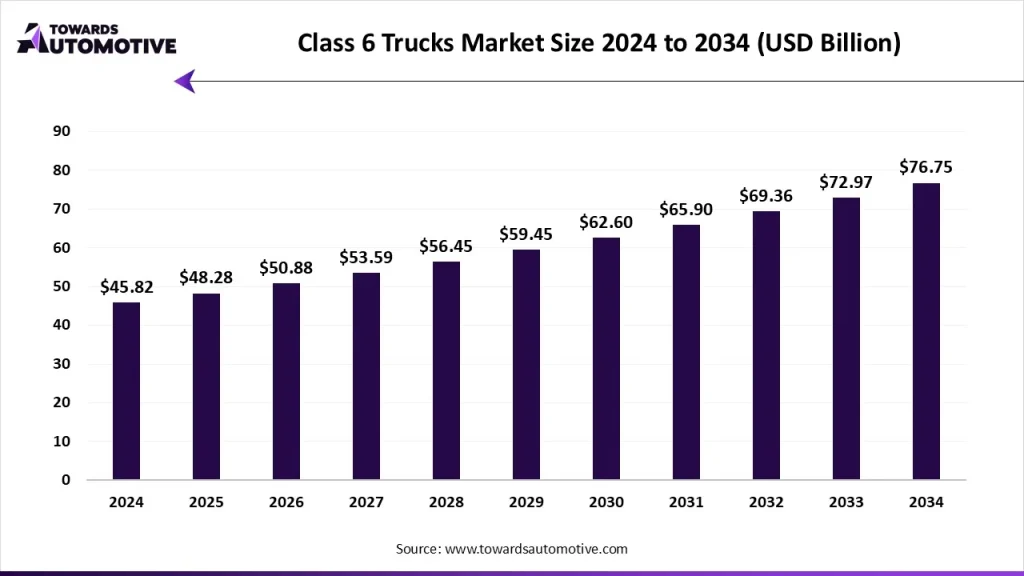

The global Class 6 Trucks Market is experiencing robust growth, propelled by the surging demand for medium-duty trucks across various sectors such as e-commerce, construction, and logistics. According to industry projections, the market is expected to grow from USD 48.28 billion in 2025 to USD 76.75 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.35% over the forecast period.

Market Overview: Momentum Driven by E-commerce and Technological Advancements

Class 6 trucks, typically used for medium-duty tasks, are witnessing increasing adoption due to their versatility, payload capacity (~15 tons), and evolving fuel options. North America currently leads in market revenue, while Asia Pacific is projected to grow at the fastest pace due to increased construction and logistics demand.

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/download-databook/1752

Key drivers include:

-

Rising e-commerce activities in the U.S., France, and other nations.

-

Growing preference for electric trucks and development of hydrogen fuel cell technologies.

-

Ongoing automation in the form of driverless trucks.

Market Trends in 2025

1. Strategic Partnerships

Leading automakers are forming alliances to develop advanced Class 6 trucks that meet the changing needs of end-users. Collaborations enhance innovation and accelerate time-to-market.

2. E-commerce Boom

The surge in online shopping is a major catalyst, especially in urban and last-mile delivery contexts. Retail giants and logistics players are increasingly investing in Class 6 vehicles to improve efficiency.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-sample/1752

3. Adoption of Hydrogen-Powered Trucks

Hydrogen fuel-cell trucks are gaining momentum in the logistics sector due to their zero-emission profile and reduced long-term maintenance costs.

Segment Analysis

Body Type Insights

Straight Trucks Dominate

In 2025, straight trucks hold the largest share. These vehicles are widely used for transporting:

-

Medical supplies and vaccines

-

Food and beverages

-

Construction materials

-

General cargo

Their popularity stems from ease of maneuverability, lower operating costs, and faster loading/unloading capabilities.

Tractor Trucks Grow Fastest

The tractor trucks segment is witnessing the fastest growth. Increasing sales of autonomous and hybrid models, coupled with features like smart fuel management and enhanced safety, contribute to this surge.

Fuel Type Insights

Diesel Leads the Pack

Diesel remains the top fuel type due to:

-

High torque output

-

Better fuel efficiency

-

Engine longevity

Truck manufacturers are doubling down on diesel-powered variants through joint ventures and product enhancements.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Electric Trucks Show Highest Growth

Electric Class 6 trucks are set to grow at the highest CAGR during the forecast period. Key contributors include:

-

Government policies supporting EV infrastructure

-

Technological advances in electric powertrains

-

Rising investments from major automakers in EV truck development

Application Insights

Construction Sector Leads

Construction applications account for the largest market share, driven by:

-

Urban development projects in India, Germany, the UK, and others

-

Government funding in infrastructure

-

Partnerships between OEMs and construction firms

Utilities Segment on the Rise

The utilities sector is projected to grow significantly due to the increasing need for advanced, efficient truck fleets. Notably, India’s Ministry of New and Renewable Energy announced hydrogen-powered truck deployment projects in early 2025.

Regional Insights: Spotlight on Asia Pacific

While North America currently holds the lion’s share, Asia Pacific is poised for aggressive expansion. Key highlights include:

-

China leading within Asia Pacific, supported by strong investments in manufacturing

-

Booming cross-border trade and logistics development initiatives

Recent Industry Developments

-

April 2025: Ballard Power Systems, Forsee Power, and Linamar Corporation partnered to develop Class 6 trucks in the U.S. (Source: Trucks Parts Service)

-

September 2024: Battle Motors launched Striker, a non-CDL Class 6 truck emphasizing safety and comfort. (Source: Trucks Parts Service)

-

May 2024: Isuzu and Cummins collaborated to release a new Class 6 truck range for North America. (Source: OEM Off-Highway)

In addition, Scania’s truck segment revenue rose from SEK 125,149 million in 2023 to SEK 136,584 million in 2024, reflecting growing demand.

Conclusion: A Promising Road Ahead

The Class 6 Trucks Market is on a high-growth trajectory, with diesel and electric segments driving powertrain evolution, and straight trucks continuing to dominate applications. With strong contributions from construction and utility sectors and growing momentum in hydrogen and electric technology, the industry is poised for a transformative decade.

Source : https://www.towardsautomotive.com/insights/class-6-trucks-market-sizing