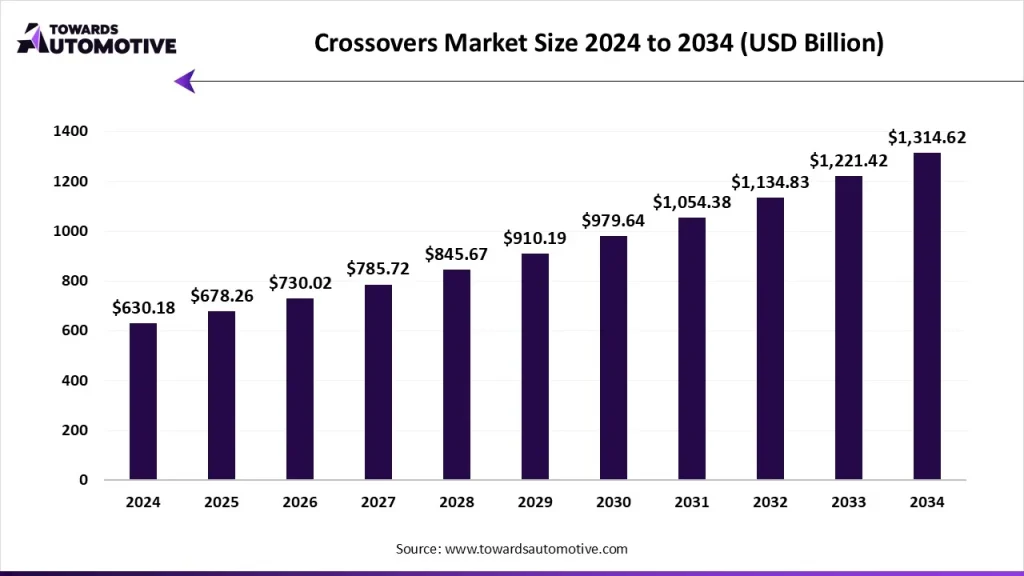

The global crossovers market is experiencing rapid expansion, with projections indicating a surge from USD 678.26 billion in 2025 to USD 1314.62 billion by 2034. This growth, driven by a steady compound annual growth rate (CAGR) of 7.63%, reflects shifting consumer preferences, rising investments in EV technologies, and a growing focus on fuel efficiency.

Introduction to the Crossovers Market

Crossovers have carved a significant niche in the automotive sector, combining the practicality of SUVs with the maneuverability of passenger cars. This market spans various types—including compact, mid-size, and full-size crossovers—powered by internal combustion engines (ICE) and electric propulsion systems. These vehicles feature both manual and automatic gear transmissions, offering flexibility to diverse consumer bases globally. The increasing affordability of compact crossovers and the rising demand for electric and hybrid options are key contributors to market growth.

Market Overview and Regional Highlights

North America: Market Leader in 2025

North America dominated the crossovers market in 2025, owing to rising EV adoption, robust investment in automotive technologies, and a strong presence of industry giants like General Motors and Ford. The U.S., in particular, led the region with increasing demand for mid-size and electric crossovers, enhanced infrastructure for EV charging, and a tech-driven approach to vehicle design.

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/download-databook/1754

Europe: Fastest Growing Region

Europe is projected to grow at a notable pace throughout the forecast period, supported by strong demand for luxury and mid-size crossovers. Countries such as Germany, France, and the UK are witnessing increased investments in EV manufacturing and advanced vehicle technologies. The presence of brands like Volkswagen, Mercedes-Benz, and Renault further fuels this momentum.

Segmental Insights

By Type

Compact Crossovers Dominate in 2025

Compact crossovers captured the largest market share in 2025, driven by their affordability and popularity in developing markets. Automakers are investing heavily in this segment to offer electric variants with extended range and enhanced features. A notable example includes Xiaomi’s launch of the YU7, a compact crossover with an impressive 835 km range per charge.

Mid-Size Crossovers on the Rise

Mid-size crossovers are expected to witness robust growth as they become increasingly popular among corporate buyers seeking comfort, status, and performance. Companies like Lucid are working on high-range EV mid-size crossovers, targeting launches in the near future.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-sample/1754

By Propulsion

ICE Leads in 2025

Internal combustion engine crossovers held the majority share in 2025 due to their reliable performance and existing infrastructure in regions like Asia and Africa. In countries where EV charging networks are still underdeveloped, ICE vehicles remain a preferred choice. Tata Motors, for example, introduced the diesel-powered Curvv in India to cater to this demand.

Electric Segment Growing Fast

Electric crossovers are forecasted to grow at the fastest rate. The rising number of government incentives, improved battery technologies, and new EV production plants—such as BYD’s billion-dollar facility in Indonesia—are major growth enablers.

By Gear Transmission

Manual Gear Systems Lead

Manual crossovers dominated the market in 2025, especially in price-sensitive markets. They offer better mileage and driving control at a lower cost. Tata’s 2025 Punch, with a 5-speed manual gear system, is a testament to this growing trend in mid-income nations.

If you have any questions, please feel free to contact us at sales@towardsautomotive.com

Automatic Segment to Expand Rapidly

Demand for automatic gear systems is accelerating in developed regions where convenience and premium vehicle features are prioritized. The growth of electric vehicles—which predominantly use automatic transmissions—is also propelling this segment.

Industry Trends and Strategic Developments

Investment Initiatives

Automakers are significantly investing in infrastructure to scale up crossover production. In June 2025, General Motors committed USD 4 billion to build a dedicated crossover manufacturing facility in Kansas City, highlighting the growing demand in North America.

Strategic Partnerships

Collaborations are playing a pivotal role in introducing high-performance crossovers. One example is the June 2025 partnership between Mullen and Faissner Petermeier Fahrzeugtechnik AG to bring the Mullen FIVE RS EV to the German market.

Rising Demand for Full-Size Crossovers

Full-size crossovers are gaining popularity for their spacious interiors and enhanced tech features. Huawei’s Aito M8, launched in China with a 15.6-inch screen and OS4, reflects consumer interest in feature-rich, luxury crossovers.

Notable Recent Developments

-

Kia launched the EV6 in India (March 2025), equipped with ADAS 2.0 and LED technology.

-

Mitsubishi revealed plans for a Nissan Chill-Out concept-based EV crossover for the U.S. (January 2025).

-

Vinfast is targeting the Indian market with a new crossover by mid-2025.

-

Mazda launched the electric EZ-60 crossover in China with a 600 km range (April 2025).

Conclusion

The crossovers market is poised for transformative growth, with both traditional and electric vehicle segments contributing to expansion. As automakers embrace innovation, invest in production, and form strategic alliances, consumers can expect more efficient, tech-integrated, and diverse crossover offerings in the years ahead. With North America leading the way and Europe catching up fast, the global crossover industry is set to redefine modern transportation.

Source : https://www.towardsautomotive.com/insights/crossovers-market-sizing