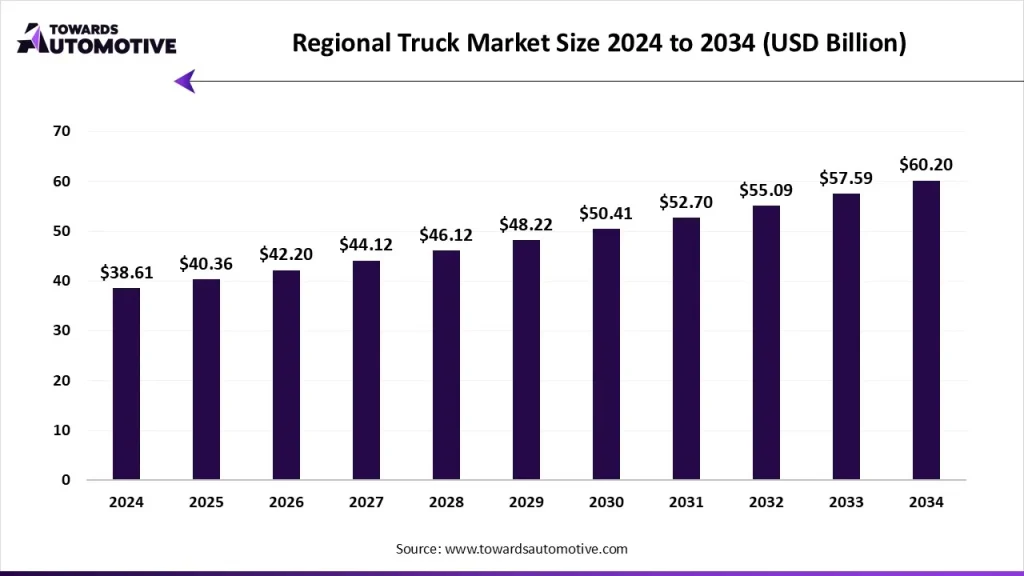

The regional truck market is poised for substantial growth in the coming decade. From USD 38.61 billion in 2024, it is projected to reach USD 60.2 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.53%. This growth is driven by various factors, including increased demand from the e-commerce sector, technological advancements in truck manufacturing, and substantial investments in autonomous and electric vehicles. In this article, we delve into the major trends, fuel preferences, and axle configurations shaping the regional truck market, as well as the latest developments in the industry.

Key Highlights of the Regional Truck Market

-

Revenue Growth: The regional truck market is forecast to grow from USD 40.36 billion in 2025 to USD 60.2 billion by 2034, with a CAGR of 4.53%.

-

Asia Pacific Dominates: Asia Pacific leads the market in terms of revenue generation, while North America is expected to grow significantly during the forecast period.

-

Fuel Trends: Diesel trucks hold the largest market share, but hybrid electric trucks are rising rapidly.

-

Axle Configuration: The 64 configuration currently dominates the market, while the 42 configuration is expected to grow at the highest rate.

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/download-databook/1751

Market Dynamics and Growth Drivers

The regional truck market has evolved significantly due to factors such as rapid e-commerce expansion, increased demand for heavy-duty trucks, and advancements in logistics technologies.

Rising Demand from E-commerce

One of the major drivers behind the growth of the regional truck market is the increasing demand for heavy-duty trucks from the booming e-commerce sector. With the rise of online shopping, logistics companies require larger and more efficient trucks to handle increased shipments. This trend is particularly evident in developed nations such as the U.S., Canada, and Germany, which are witnessing substantial growth in the logistics and freight sectors.

Technological Innovations

Technological innovations, especially in autonomous driving and electric vehicle (EV) technologies, are shaping the future of the regional truck market. Companies are increasingly investing in autonomous trucks to improve efficiency and reduce operational costs. Additionally, advancements in hydrogen fuel cell technologies are leading to the development of hydrogen-powered trucks, offering a cleaner and more sustainable alternative to traditional diesel-powered trucks.

Investment in Infrastructure

Governments around the world are investing heavily in road infrastructure to facilitate smoother and more efficient transportation. In India, for example, the government allocated USD 32.68 billion in 2024 for improving the nation’s road network, which is expected to support the growth of the regional truck market by enhancing transportation efficiency.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-sample/1751

Trends to Watch in 2025

Partnerships in Truck Manufacturing

Partnerships between truck manufacturers and governments are becoming increasingly common. These collaborations are designed to boost the production of electric trucks and cater to the evolving needs of industries. A notable example is Blue Energy Motors’ partnership with the Maharashtra government in India, announced in January 2025, to enhance electric truck manufacturing capabilities in the region.

Hydrogen-Powered Trucks

Hydrogen trucks are gaining traction as manufacturers aim to reduce emissions from the logistics sector. BMW’s launch of a new range of hydrogen trucks in Germany in February 2025 exemplifies the growing interest in this technology. These trucks are designed to transport goods across key routes, such as those between Landsberg, Leipzig, and Nuremberg.

Advancements in Road Infrastructure

Many governments are prioritizing the development of road infrastructure to improve logistics operations. For instance, India’s US$ 32.68 billion investment is aimed at boosting road infrastructure, which will, in turn, support the growth of the regional truck market.

Fuel Insights: Diesel vs. Hybrid Electric

Diesel Trucks: The Market Leader

Diesel trucks currently dominate the regional truck market, primarily due to their established presence in the industry and the growing demand from sectors such as mining and construction. Heavy-duty trucks, particularly those used in e-commerce and long-haul logistics, continue to rely heavily on diesel engines for their power and efficiency.

Hybrid Electric Trucks: The Fastest-Growing Segment

Although diesel holds the largest share, hybrid electric trucks are emerging as the fastest-growing segment. This growth can be attributed to the increasing demand for cleaner, more fuel-efficient vehicles. Hybrid trucks offer a balance between performance and sustainability, making them particularly attractive to companies looking to reduce their carbon footprint.

If you have any questions, please feel free to contact us at sales@towardsautomotive.com

Axle Configuration Insights: 64 vs. 42

6*4 Trucks: The Market Dominator

The 6*4 axle configuration currently leads the regional truck market, driven by the high demand for heavy-duty trucks in sectors such as construction, e-commerce, and mining. These trucks are equipped with four wheels for stability and increased load-carrying capacity, making them ideal for long-haul and heavy-duty applications.

4*2 Trucks: The Rapidly Growing Segment

The 42 axle configuration, which is typically used for lighter-duty applications such as last-mile deliveries, is expected to experience the highest growth during the forecast period. The lower maintenance costs, fuel efficiency, and increasing demand for small goods transportation contribute to the rise of 42 trucks in the regional market.

Industry Leaders and Competitive Landscape

The regional truck market is home to several prominent players who are leading the charge in innovation and market expansion. Key companies include:

-

Daimler Truck

-

MAN SE

-

Navistar

-

PACCAR Inc.

-

Scania AB

-

Ford Motor

-

Hino Trucks

These companies are heavily investing in research and development, forming strategic partnerships, and launching new products to maintain their competitive edge. For instance, in March 2025, Traton Group partnered with Applied Intuition to deploy advanced software in the commercial vehicle sector, while Scania’s partnership with Regroup aims to develop autonomous trucks for the mining sector in Australia.

Recent Developments

-

Daimler Trucks opened a new production facility in Indonesia in June 2025, aimed at increasing truck manufacturing in the region.

-

Kenworth launched the T680E, a battery-electric truck designed for North American markets in May 2025.

-

Windrose introduced an electric truck in Phoenix, U.S. in April 2025, designed to enhance logistics operations.

Conclusion

The regional truck market is set for impressive growth, driven by technological advancements, rising demand from e-commerce, and substantial infrastructure investments. While diesel trucks currently dominate the market, hybrid electric and hydrogen-powered vehicles are emerging as key players in the future of sustainable transport. As manufacturers continue to innovate and invest in new technologies, the regional truck industry will play a vital role in shaping the future of global logistics.

Source : https://www.towardsautomotive.com/insights/regional-truck-market-sizing